In an era defined by rapid digital transformation and fluctuating market economies, the concept of “saving money” has evolved far beyond simply putting coins in a jar. Today, being a financially savvy individual means navigating a complex landscape of digital offers, subscription models, and global marketplaces. To maintain a healthy portfolio while enjoying a high quality of life, one must master the strategic use of modern tools designed to optimize every dollar spent.

The Psychology of Intentional Spending

Most financial advisors agree that the biggest threat to a household budget isn’t the large, planned purchases, but the “micro-leaks”—small, impulsive spends that go unnoticed. Intentional spending is the practice of ensuring that every outflow of cash aligns with your personal values and long-term goals.

However, intentionality doesn’t mean deprivation. It means sourcing the things you need and want through the most cost-effective channels available. This is where the integration of digital resources becomes critical. By utilizing a comprehensive platform for digital coupons, consumers can bridge the gap between their desires and their budget constraints, effectively lowering the “cost of living” without lowering their “standard of living.”

Building a Framework for Discounts

Why do some people always seem to get better deals? It isn’t luck; it’s a system. A professional approach to shopping involves three main pillars:

- Timing: Understanding seasonal sales cycles (Black Friday, Cyber Monday, End-of-Season clearances).

- Stacking: The art of combining a store sale with a manufacturer’s coupon and a cashback offer.

- Verification: Never reaching the checkout page without checking for a valid promotional code.

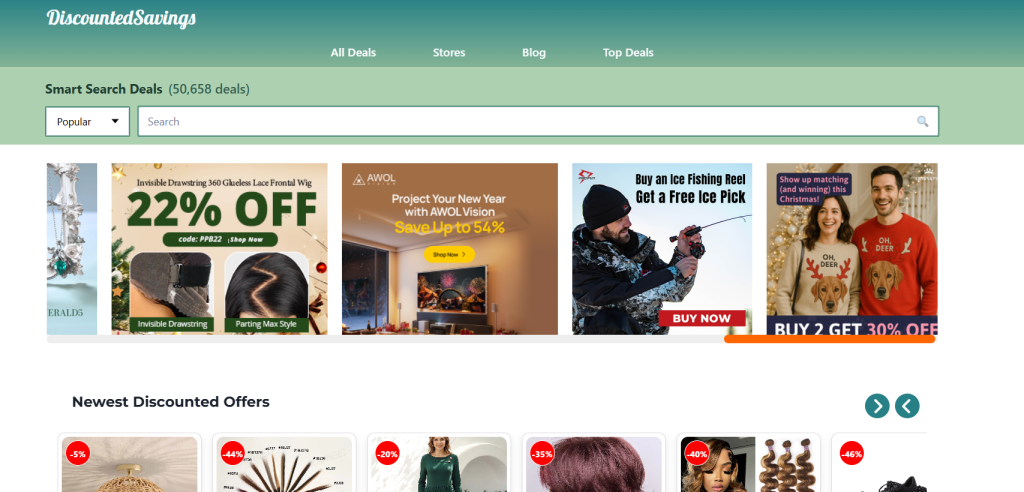

The landscape of retail is competitive. Brands are constantly releasing incentives to capture market share. The challenge for the consumer is finding a reliable aggregator that filters the noise. For instance, when looking for verified deals across various categories, smart shoppers often turn to discountedsavings.com to ensure they aren’t missing out on active promotions that could shave 20% to 50% off their total bill.

Leveraging Technology for Budget Optimization

We are living in the golden age of the “Savings Economy.” Browser extensions, mobile apps, and dedicated deal portals have automated the hunt for discounts. But technology is only as good as the data it provides. The most successful savers are those who treat price optimization as a minor hobby rather than a chore.

When you integrate these habits into your daily routine, the compound effect is staggering. Saving $50 a month through strategic couponing results in $600 a year—enough for a vacation, an emergency fund contribution, or a significant investment in a high-yield account.

Conclusion: The Long-Term Vision

Financial freedom is rarely the result of a single windfall; it is the accumulation of thousands of small, smart decisions. By staying informed, utilizing high-quality deal aggregators, and maintaining a disciplined approach to checkout screens, you reclaim control over your financial destiny.

In the digital marketplace, the “sticker price” is merely a suggestion for the uninformed. For the proactive consumer, the real price is always lower, provided you know where to look and which tools to trust. Start treating your shopping sessions as a strategic game where the prize is your own financial security.