In today’s fast-paced world, financial transactions are becoming increasingly digital. Mobile banking apps and online payment platforms have revolutionized the way we manage our finances and exchange money. Two popular names in this digital finance space are Chime and Zelle.

What is Chime?

Chime is a neobank that has gained immense popularity in the United States in recent years. It’s not a traditional bank with brick-and-mortar branches; instead, it operates entirely online and through its mobile app. Chime offers a wide range of financial services, including checking and savings accounts, credit cards, and more. One of the key features that sets Chime apart from traditional banks is its commitment to providing fee-free banking. This means no monthly maintenance fees, no overdraft fees, and no minimum balance requirements. Chime also offers early direct deposit, allowing you to get your paycheck up to two days earlier than with traditional banks.

Chime has gained a large and dedicated user base due to its user-friendly interface, ease of use, and customer-centric approach. It has become a popular choice for people looking for a hassle-free banking experience. But can you use Chime with Zelle? In this blog, we will explore the compatibility of these two services, their features, and the benefits of using them together to simplify your financial life.

What is Zelle?

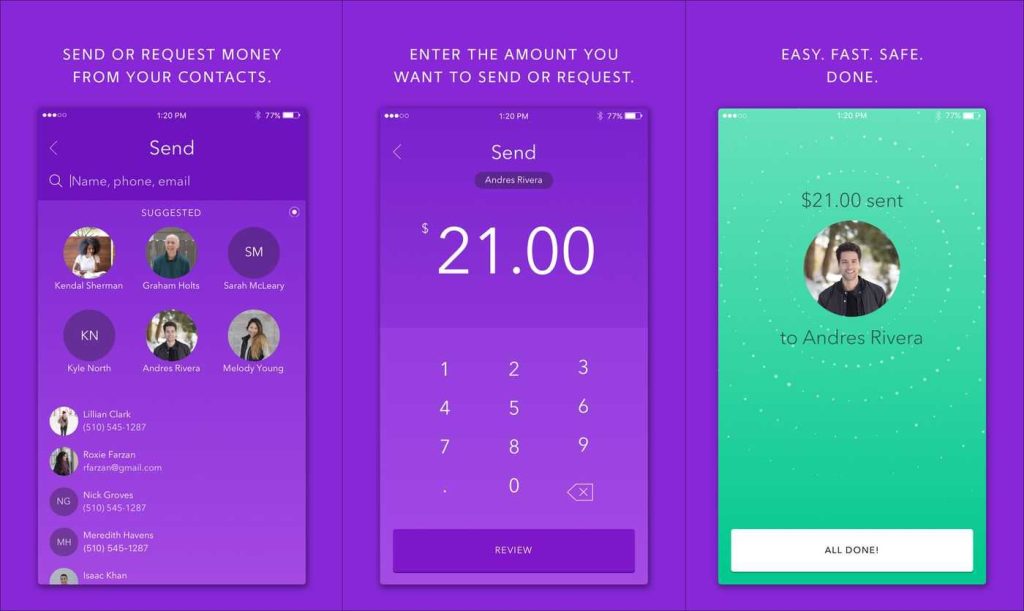

Zelle, on the other hand, is a digital payment platform that allows users to send and receive money directly from their bank accounts. It’s a convenient way to transfer money to friends, family, or anyone else without the need for cash or checks. Zelle is integrated with many major banks and financial institutions in the United States, making it accessible to a broad user base. One of the standout features of Zelle is its real-time money transfer capability. When you send money using Zelle, it typically arrives in the recipient’s account within minutes. This makes it an ideal choice for splitting bills, paying rent, or sending money in emergencies.

Importance of Chime and Zelle

Now that we have a basic understanding of Chime and Zelle, let’s delve into why these two services are essential and how they can complement each other.

Seamless Integration

The good news is that Chime and Zelle are compatible, making it easy for Chime users to link their accounts with Zelle. This integration allows you to leverage the strengths of both services. Chime provides you with a full-fledged online banking experience, while Zelle simplifies peer-to-peer money transfers.

Simplified Transactions

When you use Chime with Zelle, you can seamlessly transfer money to anyone in your contact list, even if they don’t have a Chime account. This simplifies transactions, especially when you need to settle bills or split expenses with friends or family members.

Real-Time Transfers

Zelle’s real-time money transfer feature comes in handy when you need to send or receive money urgently. By connecting your Chime account with Zelle, you can take advantage of this rapid transfer capability for added convenience.

You can find out more benefits of using Chime with Zelle on any of the tech blogs in USA.

Setting Up Chime with Zelle

Setting up Chime with Zelle is a straightforward process that allows you to enjoy the convenience and speed of peer-to-peer money transfers while benefiting from Chime’s user-friendly banking features. In this section, we will guide you through the steps to link your Chime account with Zelle and make the most of this powerful combination.

Download the Chime Mobile App

If you don’t already have the Chime mobile app, start by downloading it from the App Store (for iOS devices) or Google Play Store (for Android devices). Chime’s app is user-friendly and provides easy access to your Chime account.

Sign In to Your Chime Account

Once the Chime app is installed, open it and sign in to your Chime account using your username and password. If you’re new to Chime, you can sign up for an account within the app.

Access the “Settings” Menu

In the Chime app, navigate to the “Settings” menu. This can usually be found by tapping on your profile icon or a similar option, depending on the app’s layout.

Link Your Bank Account

Within the “Settings” menu, you should find an option to link an external bank account. This is where you will connect your Chime account with Zelle. Follow the prompts to add your bank account details, such as the bank name, account number, and routing number. Ensure that the information you provide is accurate.

Verification Process

Chime may require you to verify your linked bank account. This can typically be done by confirming two small test deposits that Chime will make into your external bank account. These deposits are usually less than a dollar each. Once you receive them, enter the deposit amounts in the Chime app to complete the verification process.

Confirm Your Identity

Chime may also require you to confirm your identity by providing additional information, such as your Social Security Number (SSN) and other personal details. This is a standard security measure to ensure that your Chime account is protected.

Link Your Chime Account with Zelle

Once your linked bank account is verified, you can proceed to link your Chime account with Zelle. This is where the magic happens, allowing you to send and receive money quickly and easily.

Access Zelle within Chime

In the Chime app, navigate to the section that provides access to Zelle. This may be labeled as “Send Money with Zelle” or a similar option. Once you select it, you will be guided through the process of setting up Zelle within your Chime account.

Verify Your Email or Phone Number

To use Zelle, you will need to verify your email address or phone number associated with your Chime account. This ensures that you can receive money and notifications from other Zelle users.

Start Sending and Receiving Money with Zelle

Once you have successfully set up Zelle within your Chime account, you can start sending and receiving money with ease. Simply select a contact or enter their email address or phone number, specify the amount, and send the funds. Recipients will typically receive the money within minutes.

Conclusion

In today’s digital age, financial transactions have never been more accessible and convenient. Chime and Zelle are two key players in the evolving landscape of digital finance. The good news is that you can indeed use Chime with Zelle, and doing so can enhance your financial experience in numerous ways. Chime’s fee-free banking and user-friendly interface make it an attractive option for those seeking a hassle-free banking experience. When combined with Zelle’s real-time money transfer capabilities and widespread network, you have a powerful duo at your disposal for managing your finances and making quick, secure transactions.

Click here to discover the most crucial reasons why consulting a banking lawyer can safeguard your interests and empower your financial decisions.